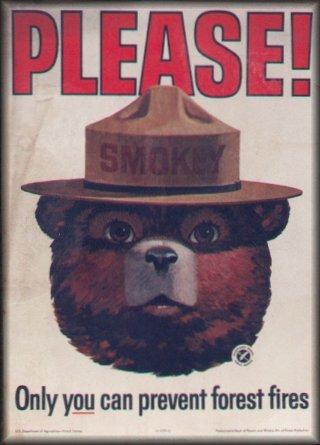

Smokey the Bear Says…

Only YOU can prevent wildfires!

Now that we are approaching the dry summer months, we are at risk for wildfires! California has had the most costly wildfires in recent years. Read on to learn the facts of California wildfires, and how you can help protect your home!

GET THE FACTS:

- In 2009 California had 405,585 acres burned by wildfires.

- In 2008 California had the most costly fire in the nation, estimated at $800 million.

- California has an estimated number of 5 million homes built in wildland areas.

- In 2008 almost 5,000 wildfire claims were filed in California.

PROTECT YOUR HOME AND FAMILY:

- Install smoke detectors; if you already have them, test them regularly!

- Keep a fire extinguisher in your home.

- Make sure your roof is constructed with fire resistant materials.

- Mark the entrance to your property clearly so that firefighters can easily locate your home.

- Keep an inventory of your possessions and store it off the premises. If your personal belongings are damaged, it will help you get the most accurate amount and help speed up the claims process.

WHAT WILL YOUR HOME INSURANCE COVER?

Your homeowner’s insurance will cover damage to your dwelling, other structures on the premises (such as a garage, tool shed, or pool), as well as damage to your personal possessions in your home. This includes furniture, clothing, electronic equipment, etc. Remember you are only covered up to your limit! Review your policy annually to be sure you are covered properly.

Your home policy will also cover extra expenses of living elsewhere if your home is so severly damaged it is no longer fit to live in. Extra expenses are paid until your home is repaired or rebuilt and includes the cost of having to live in a hotel or a rented home for a while, and even clothing.

And remember, only YOU will know if you have enough insurance coverage! Contact your agent today to review your homeowner’s insurance policy.